استعلام عن بنك التسليف كم المتبقي

Inquire about the credit bank, how much is left? The reference site provides the details of this service so that individuals who have previously obtained one of the loans offered by the Social Development Bank in the Kingdom of Saudi Arabia, so that they can view the details of the loan and know the amounts of money that have been paid and the amounts of money still remaining in their accounts, which is a service An electronic system provided by the bank in addition to many other electronic services.

What is a credit bank?

A royal decree was issued to establish the Credit Bank in 1971 with a capital of 5 million riyals with a primary objective of providing social loans. The bank’s capital reached during the year 2013 to 46 billion riyals, with the expansion of development support and lending, and in 2016 a Cabinet decision was issued to transfer it from the Credit Bank to the “Social Development Bank” as a stepping stone towards more horizons on the way to achieving sustainable development empowerment .[1]

The remaining amount in the credit bank

The Credit Bank, currently known as the Social Development Bank, provides individuals in the Kingdom of Saudi Arabia with the ability to view the installments that have been paid to the persons who borrowed from the bank, in addition to the remaining installments through the electronic account statement service available among a range of electronic services contained in the bank’s official website at The Internet, and the following are the most prominent details of this service and the mechanism for benefiting from it.

Conditions for a loan from the Credit Bank of 60 thousand riyals and how to obtain it

Inquire about the credit bank, how much is left?

All individuals who obtained loans from the credit bank can benefit from the electronic account statement service to inquire about the remaining amount in the bank, and the service can be used by following the following steps:

- Visit the official website of the Credit Bank “from here”.

- Click on the sign in to the site icon.

- Complete the entry registration process through the national entry.

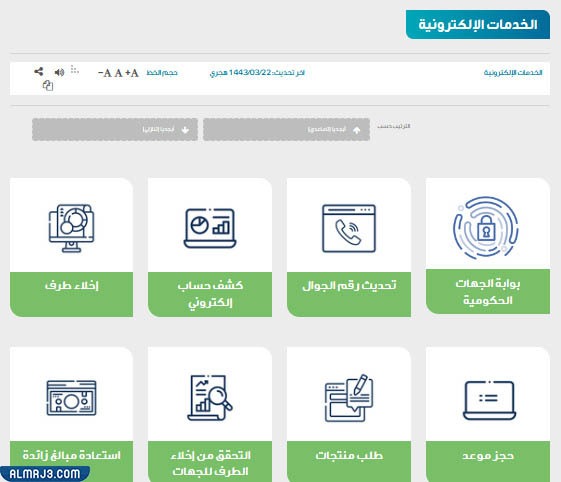

- Clicking on the list of electronic services among the main menus.

- Choose the e-statement service from among the available services.

- Click on “Go to the service” at the bottom of the service page.

- See details for remaining amount.

Inquiry about the credit bank, how much is left with the ID number?

The remaining amount in the credit bank can be inquired by the ID number by following the following steps:

- Visit the website of the Credit Bank “from here”.

- Choose the account statement service from the list of electronic services.

- Click on the Go to Service option at the bottom of the page.

- Log in through the Unified Access.

- Enter the temporary confirmation code, then click “Continue.”

- The account page appears.

- Choose the desired order and click on it.

- Choose the account statement service at the top of the page.

- Click on “Finance Account Statement”.

- The statement of account can be viewed and printed when needed.

Inquire about the credit bank, how much is left of the loan?

It is possible to inquire about the remaining amount of the loan in the credit bank through the following steps:

- Go to the official website of the Credit Bank “from here”.

- Click on the login tab of the site.

- Complete the site entry through the unified national access.

- Choosing a list of electronic services from among the main sections.

- Choose the electronic account statement service.

- Follow the necessary instructions for the service.

- View the required details in the account statement.

Inquiry about the last installment of the credit bank

The steps provide individuals with the ability to inquire about the last installment in the credit bank:

- Visit the Credit Bank website “from here”.

- Choose the account statement service from the electronic services tab.

- Select the “Go to Service” tab.

- Log in to the site through the unified access.

- Enter the confirmation code and click Continue.

- The account page appears, where the desired request is clicked.

- Clicking on the account statement at the top of the page, then “Finance Account Statement”.

- View the account statement details and print it.

Inquiry about the guarantor in the credit bank

The sponsor can be inquired about in the credit bank by following the following:

- Log in to the user’s account in the Credit Bank “from here”.

- View the list of loans.

- Select the loan you want to inquire about.

- Click on the check icon next to the loan.

- See the details required for the sponsor.

Conditions of the guarantor in the Credit Bank 1443 and the method of inquiring about the guarantor in the Credit Bank

Inquiry about the cancellation of credit bank loans

Individuals can benefit from the service of inquiring about the cancellation of the credit bank loan from the Ministry of Finance by following the following steps:

- Go to the loan exemption inquiry service “from here” directly.

- View the service details and then agree to the terms.

- Click on “Go to Service”.

- Follow the instructions and instructions required to transfer to the service.

- Write the ID number in the space provided.

- Writing the date of birth using the calendar provided by the service.

- Click on the search option to view the details.

credit bank loans

The Social Development Bank provides different types of financing to many categories, according to special regulations for each category. The loans provided in the Bank are as follows:

- Social funding: This funding targets Saudi citizens who receive a limited income to be able to overcome the financial circumstances they face, and to work to help these individuals pay the financial obligations imposed on them.

- Zod Savings Finance: This finance provides individuals with a plan to contribute to supporting individuals and helping them cover their financial needs by saving monthly sums of money.

- Self-employment financing: The self-employment financing program helps individuals in the Kingdom to open private projects and overcome the financial problems they face during the opening of these projects.

- Productive Families Financing: The Productive Families Financing Program aims to increase the efficiency and quality of what these families produce, and to encourage and support the Saudi local economy.

- Provide generational savings financing: It is the financing provided by the Credit Bank in the context of helping children and young people to save money within the provision of many incentives aimed at enriching the financial culture of these age groups.

Conditions for obtaining a loan from a credit bank

The conditions that are required to be fulfilled to obtain loans from the credit bank vary according to the type of loan to be obtained, and the following is the detail of that:

family loan terms

The following are the most important conditions required by the credit bank to enable individuals to obtain a family loan from the credit bank:

- The age of the individual should not be more than 70 years and the sponsor’s age should not be more than 55 years.

- The maximum financing limit for individuals between the ages of 60 and 65 years is 30,000 riyals.

- The maximum financing limit for individuals between the ages of 65 and 70 years is 18,000 riyals.

- The monthly income of the individual borrower should not exceed 12,500 Saudi riyals.

- The per capita income of the family should not exceed 3,000 Saudi riyals.

- The per capita ratio is calculated by dividing the guardian’s monthly income by the number of individuals.

- A son/daughter is counted among the family members when they are under 24 years old, if the son is not married or employed.

- A divorced or widowed woman who is responsible for the maintenance of one or more children is entitled to apply for family finance.

Marriage loan terms

The conditions for obtaining a marriage loan from the credit bank are as follows:

- The age of the borrower should not exceed 70 years and the age of the guarantor should not exceed 55 years.

- The borrower’s income should not exceed 12,500 riyals.

- The marriage is for the first time, except for the person whose only wife has died or the person who divorced his wife before consummation of her.

- The wife must have Saudi nationality.

- Obtaining the approval of the competent authorities if the wife does not have the nationality of one of the Gulf Cooperation Council countries.

- Submit an official marriage contract, notarized by the competent court.

- No more than two Hijri years have passed since the date of the attested contract.

Self Employed Loan Terms

The Saudi Credit Bank has identified several conditions that must be met by persons wishing to obtain a self-employment loan, which are the following conditions:

- The applicant for the loan must be a Saudi national.

- The age of the applicant should not be less than 18 years and not more than 60 years.

- Obtaining a self-employment document issued by the Ministry of Resources and Development.

- Obtaining all necessary licenses.

- The borrower’s monthly income should not exceed 14,000 for the paths of specialized services and participatory transportation.

- The default rate in the credit examination should not exceed 30 thousand riyals.

- That the financial and credit status of the applicant or sponsor enables him to apply for financing.

- Providing the guarantees required by the Social Development Bank.

- The applicant should not have previously benefited from one of the loans of the Social Development Bank.

- Vehicle insurance in the event that the funded self-employment is within the scope of vehicle guidance.

- The maximum repayment should be 40 or 60 months when getting the self-employment loan in kind.

- The installments must be paid on the specified dates.

How to apply for a family loan from the Social Development Bank 1443

Productive family loan terms

According to what was approved by the Credit Bank with regard to the productive family loan, the conditions necessary to obtain the loan are as follows:

- Obtaining the certificate of the productive family and specifying the activities of the project for which a loan is to be obtained.

- The applicant for the loan must be a Saudi national or one of the individuals who are treated as Saudis according to the articles of the Labor Law.

- The loan applicant must not be less than 18 years old and not more than 65 years old when applying for the loan.

- The absence of a commercial register for individuals wishing to obtain the loan.

- The monthly finance applicant’s income should not exceed 10,000 Saudi riyals, and the income for the commercial activity is not calculated.

- Provide proof of residence, provided that this proof is acceptable to the credit bank, by submitting the lease contract, the title deed, or the national address.

Credit Bank branches

The Credit Bank has several branches spread throughout the Kingdom to facilitate the task of going to branches for individuals, and the following is a list of the different branches of the bank in the Kingdom:

- Qurayyat Branch.

- Arar branch.

- Tabuk branch.

- Al-Jouf branch.

- Hafr Al-Batin Branch.

- Hail branch.

- Buraydah branch.

- Majmaah branch.

- Riyadh Women’s Branch.

- Dammam Women’s Branch.

- Al-Ahsa branch.

- Dawadmi branch.

- Medina branch.

- Yanbu branch. Jeddah Women’s Branch.

- Taif branch.

- Makkah branch.

- Wadi Al Dawasir Branch.

- Bisha branch.

- Al Baha branch.

- Al-Qunfudhah Branch.

- Khamis Mushait Branch.

- Jazan branch, women’s section.

- Najran branch.

Consolidated Credit Bank Number

The customer service of the Credit Bank in the Kingdom of Saudi Arabia can be contacted via the phone number 920008002, in addition to that, the Credit Bank was keen to provide several ways to receive inquiries and complaints submitted by citizens to work on providing the necessary information to answer them, including the bank’s email care@sdb. gov.sa, as well as the customer care account on Twitter.”from here“.

The unified toll-free Social Development Bank number for inquiries and complaints

Link to login to my bank account

Individuals can access the personal accounts they own on the website of the Credit Bank via the link len.sdb.gov.sa, by entering the necessary data required by the process of logging in to the bank’s website, so that individuals are able to benefit from the electronic services available through the website several.

Here we come to the conclusion of the article Inquire about the credit bank, how much is left? Through it, we got acquainted with the detailed steps that enable individuals to know the remaining amount in the credit bank and the installments paid, as well as many information about the bank as its branches and the mechanisms of communication with customer service in the credit bank.