حاسبة التمويل الشخصي بنك الانماء

Personal Finance Calculator Alinma Bank It is used to find out the installments to be paid when submitting a personal finance application at Alinma Bank in an online form via the internet. The reference site will explain the Alinma Bank personal finance calculator and the method of submitting a financing request for Alinma Bank in addition to financing without transferring the salary of Alinma Bank.

Development Bank

Alinma Bank is one of the newest Saudi banks in the field of banking services in the Kingdom of Saudi Arabia. It is headquartered in the Saudi capital, Riyadh, and was established in 2008. Alinma Bank provides banking services that are compatible with the provisions and controls of Islamic Sharia in more than 100 branches for men and women within the borders of the Kingdom. Alinma Bank in 2008 with a public offering of 1.5 billion shares, 10% of which were allocated to the Public Retirement Corporation, 10% to the Social Insurance Corporation, and 70% to individuals and Saudi shareholders. The capital of Alinma Bank was subsequently raised to 20 billion Saudi riyals in 2019.[1]

See also: How to subscribe to Alinma Bank 1443

Personal Finance Calculator Alinma Bank

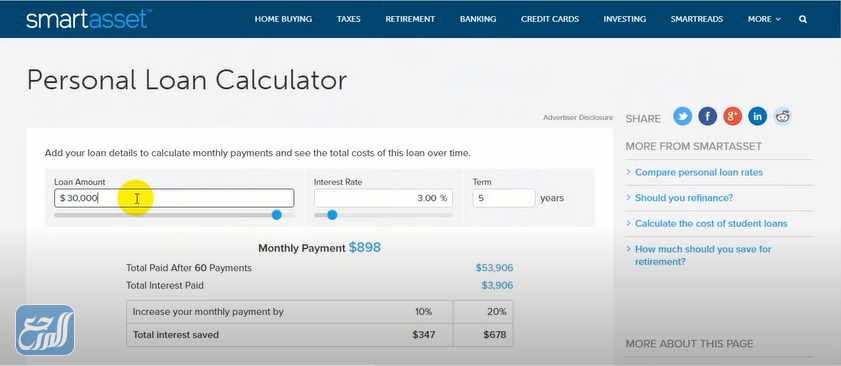

When entering the official Alinma Bank website and searching for the personal finance calculator, no result was obtained. In order to calculate the value of the monthly installments with the percentage of returns for Alinma Islamic Bank, the following steps must be followed:[2]

- Enter the personal loan calculator website “from here”.

- Write the value of the personal finance loan that you want to apply for at Alinma Bank in the specified field as shown in the figure.

- Determining the value of the annual return of the Alinma Bank on the personal financing loan as a percentage.

- Set the loan repayment term.

- The value of the monthly installment to be paid in the currency entered by the customer appears automatically.

- The site calculates the total financing loan with the total returns of the bank on the loan.

- The personal finance calculator provides the customer with the value of the interest paid on the loan to the bank separately.

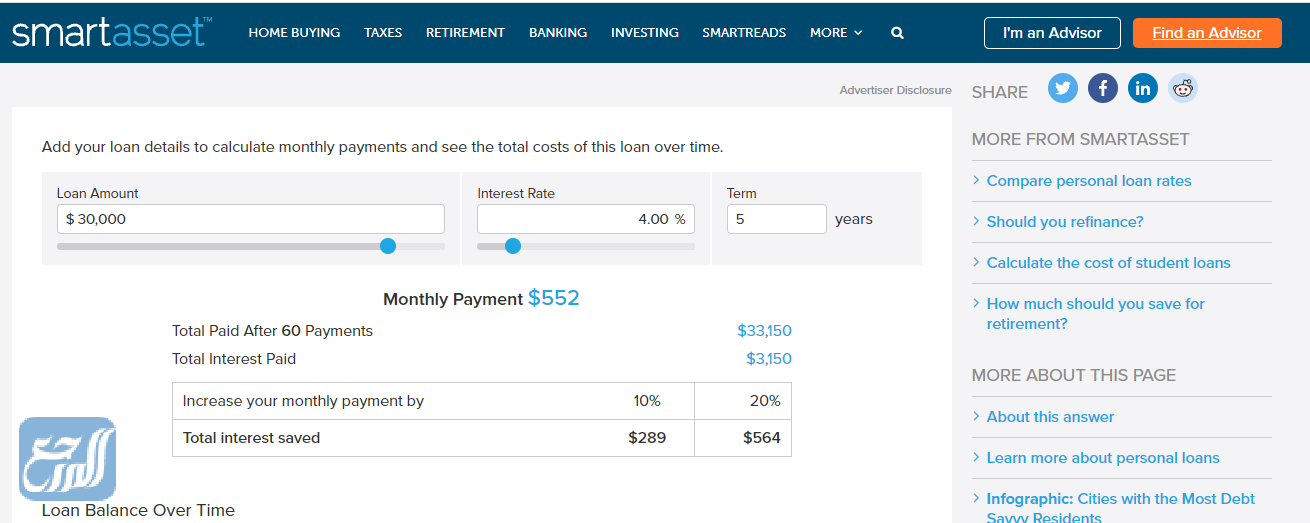

- Assuming that the customer needs a loan of 30,000 Saudi riyals over 5 years with an annual return of 4% for Alinma Bank, the result of the personal finance calculator will be as follows:

- The monthly installment on the personal finance loan is 552 Saudi riyals.

- The total return value on the personal finance loan of Alinma Bank is 3150 Saudi riyals.

- The value of the customer’s total payments on the personal finance loan after 5 years is 33,150 Saudi riyals.

See also: Best subsidized mortgage bank in Saudi Arabia 2021

Features of Personal Finance Calculator Alinma Bank

The personal finance calculator provides Alinma Bank customers with the following features and characteristics:

- Determining the value of the loan for which you want to apply for personal finance at Alinma Bank.

- Specify the time period during which the personal finance loan is required to be repaid.

- Enter the value of the annual returns specified by the bank for personal finance, real estate, cars or stocks.

- Accurately calculate the monthly installment.

- Provide the customer with the value of the annual profits and the total profits of the personal finance loan Alinma Bank.

See also: A complete guide to Saudi banks with their conditions, advantages and disadvantages

Alinma Bank Personal Finance Calculator Link

By entering directly to the personal finance calculator website “from here” customers can enter the value of the desired financing and specify the percentage of returns and the time period for financing, and the site will automatically calculate the value of the monthly installment with profits and returns.

Personal Finance Alinma Bank

The Saudi Development Bank offers many banking services in the finance sector, including the personal finance service that is compatible with the provisions and controls of Islamic Sharia, according to the following:[3]

- Personal finance loan up to SAR 2 million.

- Long repayment period of up to 60 months for customers.

See also: The best Saudi banks in order for 2021

Advantages of Personal Finance Alinma Bank

Alinma Bank has allocated customers wishing to apply for a personal finance loan with Alinma Bank with the following advantages:

- Speed in processing and approval of the funding request.

- Giving customers personal financing without the need for a sponsor.

- Possibility to apply for personal finance for Saudi clients and residents in the Kingdom of Saudi Arabia.

- Reduced administrative fees on the amount of the general financing amounting to 1% of the amount of the financing or a maximum of 5,000 Saudi riyals.

Conditions for obtaining personal financing Alinma Bank

Alinma Bank has set several conditions for those wishing to apply for personal finance, as follows:

- Opening an investment account in Alinma Bank in the name of the client.

- Fill out the local shares sale form at Alinma Bank.

- A salary identification certificate for the client certified by the employer.

- Salary transfer form to Alinma Bank.

- The applicant must be working for one of the entities known by Alinma Bank.

See also: New Al Rajhi Bank Personal Finance Terms 1443

How to apply for personal financing Alinma Bank

Customers can apply for personal finance at Alinma Bank online by following the following steps:[4]

- Entering the tab. Apply for financing directly from the official website of Alinma Bank “from here”.

- Fill out the funding application form as shown in the figure below.

- Enter the name.

- Write the national ID number or the valid residence number for the event.

- Enter the age of the customer correctly.

- Determine the current employer of the applicant.

- Writing the monthly salary in Saudi riyals.

- Select the desired type of personal finance service from the following options:

- Real estate financing.

- Equity financing.

- Car financing.

- Education service financing.

- Write down contact information.

- Enter the customer’s mobile number.

- Determine the appropriate time to contact the customer by Alinma Bank.

- Activate the visual code im not a robot.

- Press send.

- Alinma Bank processes the financing request and verifies that the conditions mentioned in the previous paragraph are met, and the response is to agree to grant financing if the conditions are met.

See also: You are eligible for the Finance Month offer to get a new personal finance. Apply now through the Al Rajhi Bank app

Alinma Bank Personal Finance Link

By entering the personal finance request tab directly “from here” customers are allowed to fill out personal data and information, specify the contact details and the type of finance, and press send so that the finance request will be processed by the bank and approval of the finance if the conditions are met.

Financing without transferring the salary of Alinma Bank

Alinma Bank provides customers with a financing service without transferring a salary to Alinma Bank, where customers are allowed to keep the salary in a specific bank and obtain a loan or personal financing from Alinma Bank, in addition to the ability for customers to apply for personal financing without transferring the salary of Alinma Bank in the event that the customer commits to an ongoing loan With the bank to which the salary is transferred.

See also: Best personal finance bank without salary transfer in Saudi Arabia 2021

Financing conditions without transferring the salary of Alinma Bank

Customers wishing to apply for financing without transferring the salary of Alinma Bank are required to fulfill the following conditions:

- The maximum monthly financial commitment of the client is 33% of the total salary value.

- Apply for personal finance on stocks and personal finance on cars only.

- Customers can apply for real estate financing champion Alinma Bank without salary transfer if the client is a government employee or a private sector employee with the condition of salary transfer using a payroll method.

- The customer has a credit history, and the financial responsibilities do not exceed 33% of the total salary.

Disadvantages of financing without transferring the salary of Alinma Bank

The disadvantages of financing without transferring the salary of Alinma Bank are as follows:

- The rate of return on a personal finance loan from Alinma Bank without salary transfer is 5% annually, which is a very high rate compared to other banks in the Kingdom.

- In the event that the customer has to apply for financing without salary transfer, Alinma Bank is advised despite the high profit rate, which is less than 12% imposed by installment companies in exhibitions and private institutions.

See also: Best Bank for Personal Loans in Saudi Arabia 2021

How to obtain financing without transferring the salary of Alinma Bank

Customers can obtain financing without transferring the salary of Alinma Bank by following the following steps:

- Entering the Alinma Bank website, tab. Apply for personal finance “from here”.

- Write the name, ID number or residence number and the age of the customer.

- Determine the employer and the monthly salary of the client.

- Set the service type Shares finance or Auto finance only.

- Enter the customer’s mobile number and specify the appropriate time to call.

- Click on the verification code and click Submit.

- The customer receives a phone call from the bank asking him to visit one of the branches and bring the identification documents required to obtain a personal finance loan without a guarantor and without salary transfer.

See also: Personal finance without a guarantor for the private sector

Link to request financing without transferring the salary of Alinma Bank

Customers who have accounts with banks other than Alinma Bank are allowed to apply for financing without directly transferring a salary “from here” and specifying the type of financing, stock financing or car financing, provided that the client’s monthly financial expenses do not exceed 33% of the total salary.

Alinma Bank application

Customers can conduct banking transactions, control accounts and request personal finance through the Alinma Bank application as follows:

- Download the Alinma Bank application for Android mobile phones “from here”.

- Download the Alinma Bank application for iOS phones “from here”.

See also: The best bank to buy debt in Saudi Arabia 2021

How to open an account in Alinma Bank online

Customers wishing to open an account with Alinma Bank can achieve this by following the following steps:[5]

- Entering the official website of Alinma Bank Online “from here”

- Click on Open an Account from the main bank options as shown in the figure.

- Click on Open your account now from the pop-up window as in the image.

- Enter the customer’s valid ID or residency number in the Kingdom of Saudi Arabia.

- Agree to the terms and conditions and click Next.

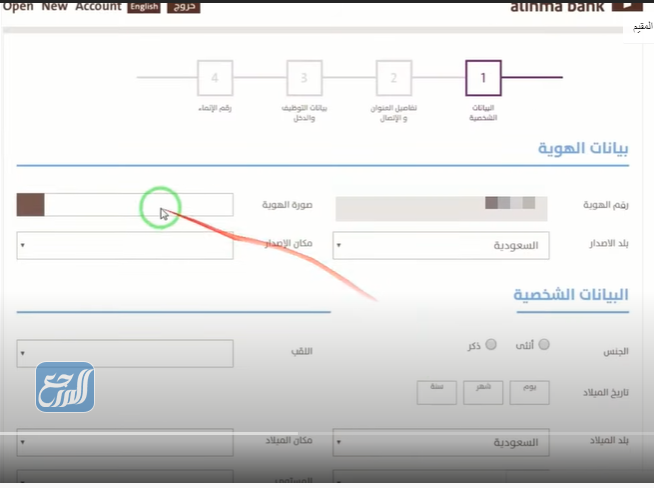

- Fill in the identity data, which includes the following:

- ID photo.

- Country of Issue.

- Place of issue.

- Writing personal data, which includes the following:

- sex.

- Title.

- Date of birth, country of birth and place of birth.

- Determine the educational level of the client.

- The preferred language of the client is Arabic.

- First and last name, nationality and country of residence.

- Click Next.

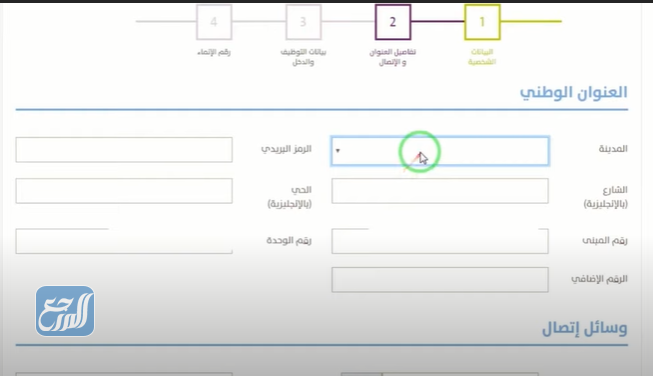

- Write the customer’s national address data, which includes each of the following information:

- City, street, building number and additional number.

- Postal code, neighborhood name in English and unit number.

- Write the customer’s mobile number and email address in the contact information field and click Next.

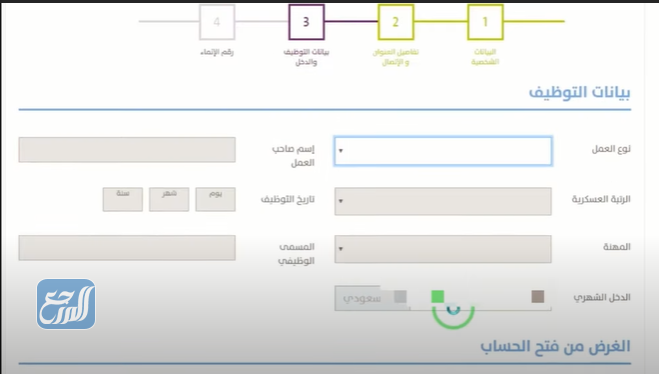

- Fill out the employment data, which includes the following information:

-

- The type of business and the name of the employer.

- Occupation and job title.

- Hiring date, day, month and year.

- Determine the value of the customer’s monthly income.

- Write the purpose of opening a personal account.

- Answer that the customer has accounts in other banks and press Next.

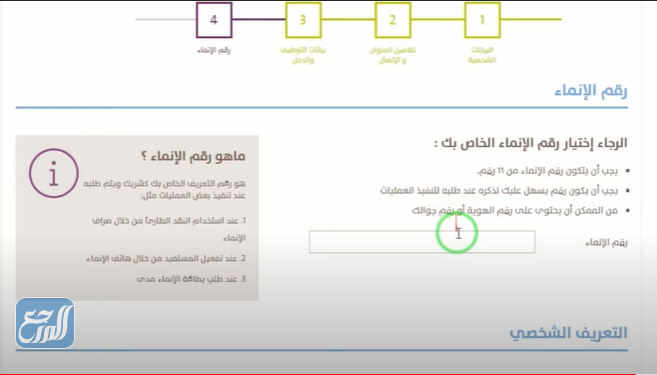

- Determine the customer’s identification number in Alinma Bank, which consists of 11 digits, and the customer must memorize it and remember it for subsequent banking transactions.

- Determine (no) self-certification for the exchange of individuals information for tax purposes and to determine consent.

- Click Confirm.

- Entering the customer’s Absher account data to authenticate the Alinma Bank account in the unified national access.

- Wait for the data to be documented and an account in Alinma Bank is successfully opened.

See also: Toll Free Number for Al Rajhi Bank for Real Estate Finance

Link to open an account in Alinma Bank

By entering the direct link “from here”, customers can enter the ID number or residence number, then fill in the personal data, national address information, employment data, and authenticate the Alinma account in Absher.

Finally, we will explain Personal Finance Calculator Alinma Bank And the features of the Personal Finance Calculator, Alinma Bank and Personal Finance, Alinma Bank and financing without transferring the Alinma Bank salary, in addition to the Alinma Bank application and the method of opening an account in the Alinma Bank.